In the category of things to keep you up at night, consider the sovereign debt requirements in the next several years.

In the category of things to keep you up at night, consider the sovereign debt requirements in the next several years.

According to Chris Puplava:

Nearly 50% of the total outstanding debt of the world’s top 10 debtor nations needs to be rolled over by the end of 2015.

This amount is staggering! For the top ten debtor nations it totals $15 Trillion! That is approximately the entire size of US annual GDP and over 20% of annual world GDP.

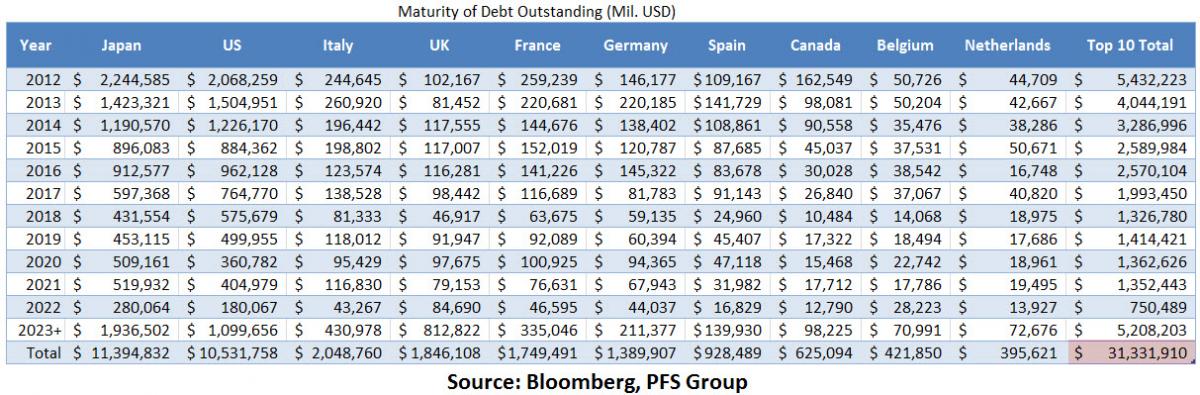

The following table shows the maturity schedule by major country:

The table only reflects only debt maturing. This amount would be difficult enough to finance, but these nations all run deficits which must be funded as well. With obvious deterioration in credit quality of these sovereigns, who will purchase this debt at today’s interest rates of near zero, at least in the US?

Mr. Puplava provides his expectation:

Mr. Puplava provides his expectation:

… global central banks will be monetizing debt in massive quantities between now and 2015 because large portions of debt will be maturing in just the next two and a half years. For example, both the US and Japan will see one fifth of their entire debt outstanding mature just between now and the end of the year, with Canada seeing 26% of their total outstanding debt mature! The other members of the top 10 are only in a slightly better position with all but the UK to see double-digit debt rollovers of their total outstanding debt between now and 2015.

Continuing deficits add to these figures. The US will need to fund new debt resulting from projected deficits almost equal to its rollovers in the next three years. The total amount of debt issuance to meet both requirements totals over $8 Trillion dollars. Other countries in the above table run annual deficits which must also be added on to their rollover requirements. Proportionately, some are bigger than what is required in the US.

Where this funding will come from is the $64 Trillion question. Very likely it will be created out of thin air by Central Banks, exactly as they have done for much of the last four years. Obviously there is a limit to how much money they can create before fiat currencies collapse.

We are in the latter stages of the debt death spiral where debt and interest payments can only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends.

We are in the latter stages of the debt death spiral where debt and interest payments can only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends.

Mr. Puplava concludes:

There is just too much debt maturing over the next couple of years for capital markets to absorb and it is highly likely we will see global quantitative easing occur as central banks step in to be buyers of last resort to help suppress interest rates and keep debt servicing costs low.

If so, and I don’t see any other sources of funding possible, the question is when and how does this Ponzi scheme collapse? These debts cannot be funded without massive debasement of the currency — all currencies.

If so, and I don’t see any other sources of funding possible, the question is when and how does this Ponzi scheme collapse? These debts cannot be funded without massive debasement of the currency — all currencies.

Nothing has been done to stop this march to ruin by the political classes. Nothing will be done! When this ends will be determined not by politicians but by markets. Markets will eventually discipline politicians and all who trusted them.

“Got Gold?”

Well what can one say about the folly of humanity

Folly over 2000 years we know

One did expect more of America and perhaps less of such a mad/ unbelievable slide into fiscal insanity

What will it look like in cities when the defaults and mad zimbabwe-like infaltion hits? Depression and genuine poverty ? Not manufactured entitled chicago nonsense!

How ’bout, “Got silver?”

Whichever PM or combination thereof, if you believe the thesis of this article then the only safe bet is to acquire the physical form and hold it in a secure place yourself. Any paper (mining stocks included) has serious counterparty risk and will undoubtedly fold along with the fiat currencies. It is certainly possible to catch profitability in the short or even medium term but who is to say when it will be too late to jump off the train that is approaching the end of the line and concurrently accelerating to full speed?

Absolutely

Not only do I have gold, I bought/created a gold mining operation in Canada. I saw the tsunami coming and grabbed a giant surf board.

The entire operation or stock in one? I have recently purchased NGM and NOX on Canadian venture. They have large indicated and inferred oz, at a very conservative estimated cost of mining $1000 per oz, means that the gold in the ground is still worth several times more than the market cap. There are likely dozens of Canadian resource companies, in various sectors, with stories like that, with low market cap and high Net Present Value of resources in the ground.

The entire operation. Claims, excavators, mining plants, camps, etc. The whole enchilada.

Well, its a good time to buy. That is probably a great way to store a lot of gold cheaply. Congratulations. Let me know if you need a publicist/writer. Cheers.

Comments are closed.